January 31, 2014

January 30, 2014

Stock Market: The Great Collapse Back to Reality Begins

From ProfitConfidential.com

Stock Market: The Great Collapse Back to Reality Begins

Thursday, January 30th, 2014

By Michael Lombardi, MBA

“The trade” was very easy to do not long ago. Anyone with the basic knowledge of how money flows could have done it and profited.

Of course, I’m talking about the Federal Reserve “trade.” The investment strategy was straightforward: borrow money at low interest rates in the U.S., then invest the money for higher returns in emerging markets and bank the difference. If you could borrow money at three percent per annum in the U.S. and invest it for a six-percent return in emerging markets like India, why wouldn’t you?

The “trade” created a rush to emerging markets. And if you didn’t like the emerging markets, you could have invested in the stock market right here in the good old U.S.A. Again, borrowing money at a low rate to buy stocks from companies that were buying back their own stocks at the same time the Fed flooded the system with cold hard cash…how could you go wrong? (No wonder the rich got richer during the Fed’s quantitative easing programs.)

But, as I have written so many times, parties can only last for so long. Eventually, someone takes away the punch bowl. And from the looks of it, the Federal Reserve has pulled its own punch bowl.

In its statement yesterday after its two-day meeting, the Federal Reserve said, “…the Committee (has) decided to make a further measured reduction in the pace of its asset purchases…” (Source: Federal Reserve, January 29, 2014.)

In summary, the Federal Reserve will be buying $65.0 billion worth of bonds in February following its reduced $75.0 billion in purchases in January following its $85.0 billion-a-month bond buying in 2013.

The pullback on the Fed’s money printing, or what it refers to as “tapering,” is having its long-expected impact on stock prices—they’re falling like a rock. The Dow Jones Industrial Average is down a massive 830 points (five percent) so far this year, gold (unexpectedly) is rising, and emerging markets are crashing.

Read more from ProfitConfidential.com >>

Stock Market: The Great Collapse Back to Reality Begins

Thursday, January 30th, 2014

By Michael Lombardi, MBA

“The trade” was very easy to do not long ago. Anyone with the basic knowledge of how money flows could have done it and profited.

Of course, I’m talking about the Federal Reserve “trade.” The investment strategy was straightforward: borrow money at low interest rates in the U.S., then invest the money for higher returns in emerging markets and bank the difference. If you could borrow money at three percent per annum in the U.S. and invest it for a six-percent return in emerging markets like India, why wouldn’t you?

The “trade” created a rush to emerging markets. And if you didn’t like the emerging markets, you could have invested in the stock market right here in the good old U.S.A. Again, borrowing money at a low rate to buy stocks from companies that were buying back their own stocks at the same time the Fed flooded the system with cold hard cash…how could you go wrong? (No wonder the rich got richer during the Fed’s quantitative easing programs.)

But, as I have written so many times, parties can only last for so long. Eventually, someone takes away the punch bowl. And from the looks of it, the Federal Reserve has pulled its own punch bowl.

In its statement yesterday after its two-day meeting, the Federal Reserve said, “…the Committee (has) decided to make a further measured reduction in the pace of its asset purchases…” (Source: Federal Reserve, January 29, 2014.)

In summary, the Federal Reserve will be buying $65.0 billion worth of bonds in February following its reduced $75.0 billion in purchases in January following its $85.0 billion-a-month bond buying in 2013.

The pullback on the Fed’s money printing, or what it refers to as “tapering,” is having its long-expected impact on stock prices—they’re falling like a rock. The Dow Jones Industrial Average is down a massive 830 points (five percent) so far this year, gold (unexpectedly) is rising, and emerging markets are crashing.

Read more from ProfitConfidential.com >>

January 29, 2014

The Vitamins and Supplements Your Body Needs the Most

From Cleveland Clinic

The Vitamins and Supplements Your Body Needs the Most

by Michael F. Roizen, M.D.

I get asked quite often about what vitamins and supplements are best to take. It's a really confusing topic for many people. That's why I've put together a Fab 5 Vitamin and Supplement Combo of the essentials. The combo pack includes:

• Probiotics: These are great for gastrointestinal health and are associated with a decreased infection and inflammation rate.

• Vitamin D3: Essentially, D is calcium’s best friend because without it, calcium has a really tough time being absorbed into your bones. Even better, making sure you have optimal levels of D is associated with decreased risk of memory loss, heart and vascular disease, and cancer rates. (Do yourself a favor and pop your D with a healthy fat, such as a DHA supplement, or with a meal that’s made with olive oil or avocado, for instance. D is absorbed only in the presence of fat.)

• Calcium/Magnesium: Calcium is also associated with a decreased risk of death from bone fractures. But taking calcium alone can cause mucho constipation and bloating, so that’s why I always recommend taking magnesium along with it. In addition to a whole range of benefits, including maintaining muscle and nerve function and supporting the immune system, this mineral also helps keep things moving along in your intestines at a nice, steady pace.

Read more from Cleveland Clinic >>

The Vitamins and Supplements Your Body Needs the Most

by Michael F. Roizen, M.D.

I get asked quite often about what vitamins and supplements are best to take. It's a really confusing topic for many people. That's why I've put together a Fab 5 Vitamin and Supplement Combo of the essentials. The combo pack includes:

• Probiotics: These are great for gastrointestinal health and are associated with a decreased infection and inflammation rate.

• Vitamin D3: Essentially, D is calcium’s best friend because without it, calcium has a really tough time being absorbed into your bones. Even better, making sure you have optimal levels of D is associated with decreased risk of memory loss, heart and vascular disease, and cancer rates. (Do yourself a favor and pop your D with a healthy fat, such as a DHA supplement, or with a meal that’s made with olive oil or avocado, for instance. D is absorbed only in the presence of fat.)

• Calcium/Magnesium: Calcium is also associated with a decreased risk of death from bone fractures. But taking calcium alone can cause mucho constipation and bloating, so that’s why I always recommend taking magnesium along with it. In addition to a whole range of benefits, including maintaining muscle and nerve function and supporting the immune system, this mineral also helps keep things moving along in your intestines at a nice, steady pace.

Read more from Cleveland Clinic >>

January 28, 2014

2014 e-retail will be more mobile and more global

From InternetRetailer.com

2014 e-retail will be more mobile and more global

The year ahead in online retail also will include steeper shipping fees and more competitive pricing, according to a new report from Forrester Research Inc.

Katie Evans

Senior Editor

If Forrester Research Inc. is right in its predictions, retailers will want to get to work on beefing up their mobile and global offerings, exploring ways to save on shipping, and keeping a close eye on how their prices compare to those of their competitors.

The Forrester report, “Predictions 2014: US Retail eBusiness,” says mobile commerce will continue to grow and that retailers would be wise to beef up their mobile sites and apps. For example, store retailers should explore incorporating store inventory data or store maps into their mobile apps to aid shoppers browsing in stores.

Retailers that responded to the annual State of Retailing Online Survey, a joint study by Shop.org, the online commerce unit of trade group the National Retail Federation, and Forrester, finds mobile commerce is retailers’ top priority for 2014. The full study will be released Wednesday, Forrester says.

Indeed, on Black Friday, or the day after Thanksgiving, which is considered by many to be the unofficial kick-off to the holiday shopping season, one in five web purchases were made with a mobile device, according to web measurement firm comScore Inc. The following Monday, Cyber Monday, 17% of online purchases were made with a tablet or smartphone, comScore says.

Because of ever-increasing mobile sales, Forrester encourages retailers to invest as much as they can in mobile. Retailers should think about mobile offerings that make sense for their businesses, Forrester says. For example, pharmacy apps might make sense for drugstores, while flash sales may generate revenue for department stores or apparel merchants.

Read more from InternetRetailer.com >>

2014 e-retail will be more mobile and more global

The year ahead in online retail also will include steeper shipping fees and more competitive pricing, according to a new report from Forrester Research Inc.

Katie Evans

Senior Editor

If Forrester Research Inc. is right in its predictions, retailers will want to get to work on beefing up their mobile and global offerings, exploring ways to save on shipping, and keeping a close eye on how their prices compare to those of their competitors.

The Forrester report, “Predictions 2014: US Retail eBusiness,” says mobile commerce will continue to grow and that retailers would be wise to beef up their mobile sites and apps. For example, store retailers should explore incorporating store inventory data or store maps into their mobile apps to aid shoppers browsing in stores.

Retailers that responded to the annual State of Retailing Online Survey, a joint study by Shop.org, the online commerce unit of trade group the National Retail Federation, and Forrester, finds mobile commerce is retailers’ top priority for 2014. The full study will be released Wednesday, Forrester says.

Indeed, on Black Friday, or the day after Thanksgiving, which is considered by many to be the unofficial kick-off to the holiday shopping season, one in five web purchases were made with a mobile device, according to web measurement firm comScore Inc. The following Monday, Cyber Monday, 17% of online purchases were made with a tablet or smartphone, comScore says.

Because of ever-increasing mobile sales, Forrester encourages retailers to invest as much as they can in mobile. Retailers should think about mobile offerings that make sense for their businesses, Forrester says. For example, pharmacy apps might make sense for drugstores, while flash sales may generate revenue for department stores or apparel merchants.

Read more from InternetRetailer.com >>

January 24, 2014

10 Brain Foods for Kids

From webMD

10 Brain Foods for Kids

By Anne Krueger

WebMD Feature, Reviewed by Patricia Quinn, MD

"These years are critical for brain development, and what they eat affects focus and cognitive skills," psychiatrist Drew Ramsey, MD, coauthor of The Happiness Diet, says.

Food is one of many factors that affect a child's brain development.

The following 10 foods can help kids stay sharp all day long, and affect brain development well into the future.

1. Eggs

Eating a high-nutrient protein like eggs (which have nutrients including choline, omega-3s, zinc, and lutein) will help kids concentrate, Beth Saltz, RD, says.

How to Serve It: Fold scrambled eggs into a whole-grain tortilla for a filling breakfast or late-afternoon snack. "The protein-carb combo tides kids over until the next meal with no sugar-induced energy crash," Saltz says.

2. Greek Yogurt

Fat is important to brain health, says Laura Lagano, RD. A full-fat Greek yogurt (which has more protein that other yogurts) can help keep brain cell membranes flexible, helping them to send and receive information.

How to Serve It: Pack Greek yogurt in lunch with some fun mix-ins: cereal with at least 3 grams of fiber and blueberries for a dose of nutrients called polyphenols.

Or add a few dark chocolate chips. Polyphenols in cocoa are thought to keep the mind sharp by hiking brain blood flow.

3. Greens

Full of folate and vitamins, spinach and kale are part of a healthy diet linked to lower odds of getting dementia later in life. "Kale contains sulforaphane, a molecule that has detoxifying abilities, and diindolylmethane, which helps new brain cells grow," says Ramsey, coauthor of 50 Shades of Kale.

How to Serve It:

Whip spinach into smoothies for snack time.

Add it to omelets.

Saute it at dinner drizzled with olive oil (the dash of fat helps your body absorb vitamins).

Make chips out of kale: Cut kale from stems/ribs, drizzle with olive oil and a bit of salt, and bake.

4. Purple Cauliflower

Continue to read from webMD >>

January 23, 2014

How Long Can Gold Prices be Held Down? - Demand Factors

From Kitco.com

How Long Can Gold Prices be Held Down? - Demand Factors

January 20, 2014

As we discussed in our last article, China has managed to acquire well over 2,000 tonnes of gold while the gold price has fallen from $1,650 to $1,180. This is a remarkable feat in itself.

So the next logical question is, “How long can they keep on doing this without the gold price rising rapidly?” The short answer: As long as demand in the traditional markets is either lower or the same as supply. This has two aspects, first the potential for rising demand and second, the potential for falling supplies.

DEMAND

London Physical Market

The main traditional market is London, where supposedly 90% of physical gold is traded. China buys there, ‘on the dips’ by importers taking bulk supplies and shipping them to Hong Kong (and Shanghai?) as stock for the distributors to the retail traded. This is replenished according to perceived future demand, hence the premiums that appear there. It’s done in a way so as to not push prices higher. But they buy large volumes from other sources, direct.

Indian demand is routed through the London market totally, via the banks that supply India. European and U.S. physical demand accesses much of its gold there too. These buyers have been negative gold for over two years now, but particularly in the last year. Will that demand pick up?

For Europe and the U.S., we don’t expect it to do so while the U.S. is selling gold from the gold Exchange Traded Funds, based there, to switch into equities. European investors expect the same scene as we see in the U.S. now in the next two years, but we do not see selling in Europe at anywhere near the levels seen in the U.S. in 2013.

Read more from Kitco.com >>

How Long Can Gold Prices be Held Down? - Demand Factors

January 20, 2014

As we discussed in our last article, China has managed to acquire well over 2,000 tonnes of gold while the gold price has fallen from $1,650 to $1,180. This is a remarkable feat in itself.

So the next logical question is, “How long can they keep on doing this without the gold price rising rapidly?” The short answer: As long as demand in the traditional markets is either lower or the same as supply. This has two aspects, first the potential for rising demand and second, the potential for falling supplies.

DEMAND

London Physical Market

The main traditional market is London, where supposedly 90% of physical gold is traded. China buys there, ‘on the dips’ by importers taking bulk supplies and shipping them to Hong Kong (and Shanghai?) as stock for the distributors to the retail traded. This is replenished according to perceived future demand, hence the premiums that appear there. It’s done in a way so as to not push prices higher. But they buy large volumes from other sources, direct.

Indian demand is routed through the London market totally, via the banks that supply India. European and U.S. physical demand accesses much of its gold there too. These buyers have been negative gold for over two years now, but particularly in the last year. Will that demand pick up?

For Europe and the U.S., we don’t expect it to do so while the U.S. is selling gold from the gold Exchange Traded Funds, based there, to switch into equities. European investors expect the same scene as we see in the U.S. now in the next two years, but we do not see selling in Europe at anywhere near the levels seen in the U.S. in 2013.

Read more from Kitco.com >>

January 22, 2014

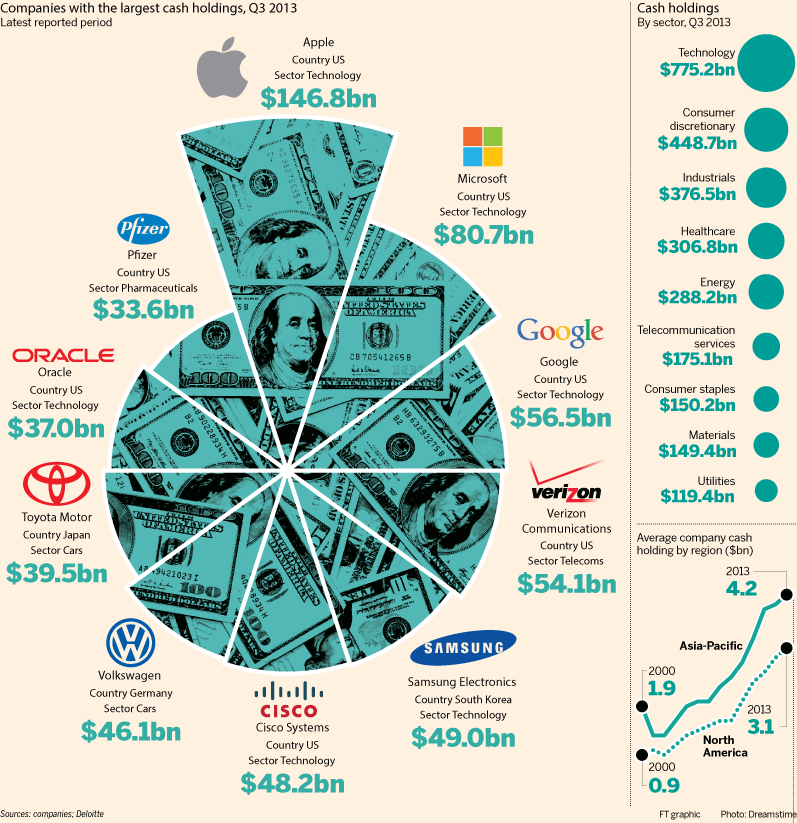

Companies With Largest Cash Holdings (Q3 2013)

Companies with Large Cash Horde

"In the wake of the financial crisis, the corporate world has built up huge cash reserves. In 2008, the non-financial members of the global S&P 1200 index – 975 of the world’s biggest companies

– had a total of $1.95tn in cash. But by the end of 2012, that level had jumped 62 per cent to $3.2tn as a result of companies hoarding cash following a banking crisis which shattered trust in sources of credit."

- Financial Times

"In the wake of the financial crisis, the corporate world has built up huge cash reserves. In 2008, the non-financial members of the global S&P 1200 index – 975 of the world’s biggest companies

– had a total of $1.95tn in cash. But by the end of 2012, that level had jumped 62 per cent to $3.2tn as a result of companies hoarding cash following a banking crisis which shattered trust in sources of credit."

- Financial Times

Polar Vortex 2

|

| TWC- Polar vortex 2 |

It is days like these, I appreciate working from home - no need to commute and no stress driving in heavy traffic. Work location independence- work from anywhere in the world - is a true blessing.

Combined with money and time independence, it is the ultimate freedom! True independence is not for everyone. For one, you have to be sufficiently disciplined enough to structure your time. It is very easy to stray into activities that are time wasting.

Of course, once in a while, I indulge in time wasting activities - and this is my freedom - when to work and when to goof off!

Cleveland Clinic researchers discover new brain protein linked to Alzheimer's

From Cleveland Clinic

Cleveland Clinic researchers discover new brain protein linked to Alzheimer's

By Brie Zeltner

January 20, 2014

CLEVELAND, Ohio— Cleveland Clinic researchers have identified a brain protein that may play a key role in the memory loss associated with Alzheimer’s disease, according to a study published online Sunday in the journal Nature Neuroscience.

The discovery, part of a wider body of work in an area of brain research called microglia inflammation, has pointed to connections between diseases such as Alzheimer’s, multiple sclerosis, neuropathic pain and Parkinson’s disease.

The brain protein, called Neuroligin-1 (NLGN1), has previously been associated with long-term memory formation, and when damaged is linked to cognitive diseases such as autism.

In current models of Alzheimer’s disease, researchers believe that sticky protein plaques, called amyloid beta, accumulate in the brain, overwhelming the brain’s natural defense and immune system—the microglia. When the microglia can’t clear out the protein plaques fast enough, they become inflamed.

When that happens, “it’s responsible for many disease processes like Alzheimer’s or other neuro-inflammatory conditions like neuropathic pain, multiple sclerosis, you name it,” said Dr. Mohamed Naguib, an anesthesiologist at the Clinic and senior author of the study.

Read more Cleveland Clinic >>

Cleveland Clinic researchers discover new brain protein linked to Alzheimer's

By Brie Zeltner

January 20, 2014

CLEVELAND, Ohio— Cleveland Clinic researchers have identified a brain protein that may play a key role in the memory loss associated with Alzheimer’s disease, according to a study published online Sunday in the journal Nature Neuroscience.

The discovery, part of a wider body of work in an area of brain research called microglia inflammation, has pointed to connections between diseases such as Alzheimer’s, multiple sclerosis, neuropathic pain and Parkinson’s disease.

The brain protein, called Neuroligin-1 (NLGN1), has previously been associated with long-term memory formation, and when damaged is linked to cognitive diseases such as autism.

In current models of Alzheimer’s disease, researchers believe that sticky protein plaques, called amyloid beta, accumulate in the brain, overwhelming the brain’s natural defense and immune system—the microglia. When the microglia can’t clear out the protein plaques fast enough, they become inflamed.

When that happens, “it’s responsible for many disease processes like Alzheimer’s or other neuro-inflammatory conditions like neuropathic pain, multiple sclerosis, you name it,” said Dr. Mohamed Naguib, an anesthesiologist at the Clinic and senior author of the study.

Read more Cleveland Clinic >>

January 21, 2014

MS: Slow Progression With Vitamin D?

From MedPageToday.com

MS: Slow Progression With Vitamin D?

Jan 20, 2014

By John Gever, Deputy Managing Editor, MedPage Today

Reviewed by Robert Jasmer, MD; Associate Clinical Professor of Medicine, University of California, San Francisco

Patients with relatively high vitamin D levels in the year after a first multiple sclerosis-like attack showed, over the next 4 years, markedly lower levels of MS disease activity and disability progression than those with lower levels, researchers found.

Each 20 ng/mL increment in serum levels of 25-hydroxyvitamin D (25-OH-D), the active metabolite of vitamin D, averaged during the first 12 months of participation in a clinical trial of interferon-beta (Betaseron) was associated with nearly 60% lower rates of new MRI lesions and clinical relapses, (both P'<'0.05) during subsequent follow-up relative to those with smaller or noincreases in 25-OH-D levels, according to Alberto Ascherio, MD, DrPH, of Harvard School of Public Health, and colleagues.

Continue reading at MedPageToday.com >>MS: Slow Progression With Vitamin D?

Jan 20, 2014

By John Gever, Deputy Managing Editor, MedPage Today

Reviewed by Robert Jasmer, MD; Associate Clinical Professor of Medicine, University of California, San Francisco

Patients with relatively high vitamin D levels in the year after a first multiple sclerosis-like attack showed, over the next 4 years, markedly lower levels of MS disease activity and disability progression than those with lower levels, researchers found.

Each 20 ng/mL increment in serum levels of 25-hydroxyvitamin D (25-OH-D), the active metabolite of vitamin D, averaged during the first 12 months of participation in a clinical trial of interferon-beta (Betaseron) was associated with nearly 60% lower rates of new MRI lesions and clinical relapses, (both P'<'0.05) during subsequent follow-up relative to those with smaller or noincreases in 25-OH-D levels, according to Alberto Ascherio, MD, DrPH, of Harvard School of Public Health, and colleagues.

January 20, 2014

NZ dollar surges; Asia eyes China money markets

From Yahoo!

NZ dollar surges; Asia eyes China money markets

By Wayne Cole

SYDNEY (Reuters) - Asian markets got off to a subdued start on Tuesday amid a dearth of major data, with the only action being a spike in the New Zealand dollar on talk interest rates could rise there as early as next week.

Leads were few and far between with most European share markets marginally lower and Wall Street shut for a holiday. That left MSCI's broadest index of Asia-Pacific shares outside Japan down a bare 0.07 percent, while Australia's main index (.AXJO) eased 0.3 percent.

Investors had a wary eye on Chinese money markets after the People's Bank of China (PBOC) announced a surprise injection of funds on Monday aimed at curbing a recent spike in rates.

Read more from Yahoo! >>

NZ dollar surges; Asia eyes China money markets

By Wayne Cole

SYDNEY (Reuters) - Asian markets got off to a subdued start on Tuesday amid a dearth of major data, with the only action being a spike in the New Zealand dollar on talk interest rates could rise there as early as next week.

Leads were few and far between with most European share markets marginally lower and Wall Street shut for a holiday. That left MSCI's broadest index of Asia-Pacific shares outside Japan down a bare 0.07 percent, while Australia's main index (.AXJO) eased 0.3 percent.

Investors had a wary eye on Chinese money markets after the People's Bank of China (PBOC) announced a surprise injection of funds on Monday aimed at curbing a recent spike in rates.

Read more from Yahoo! >>

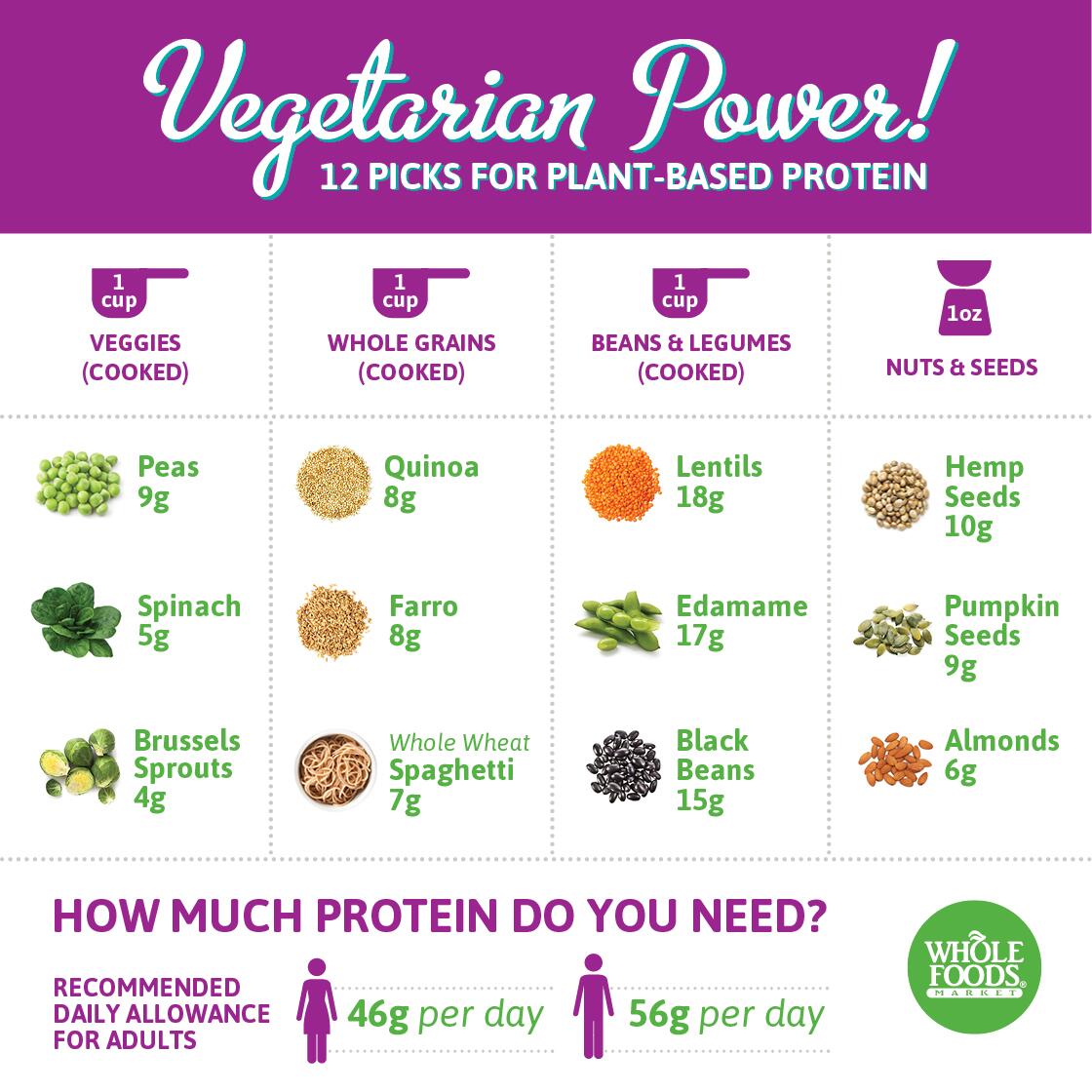

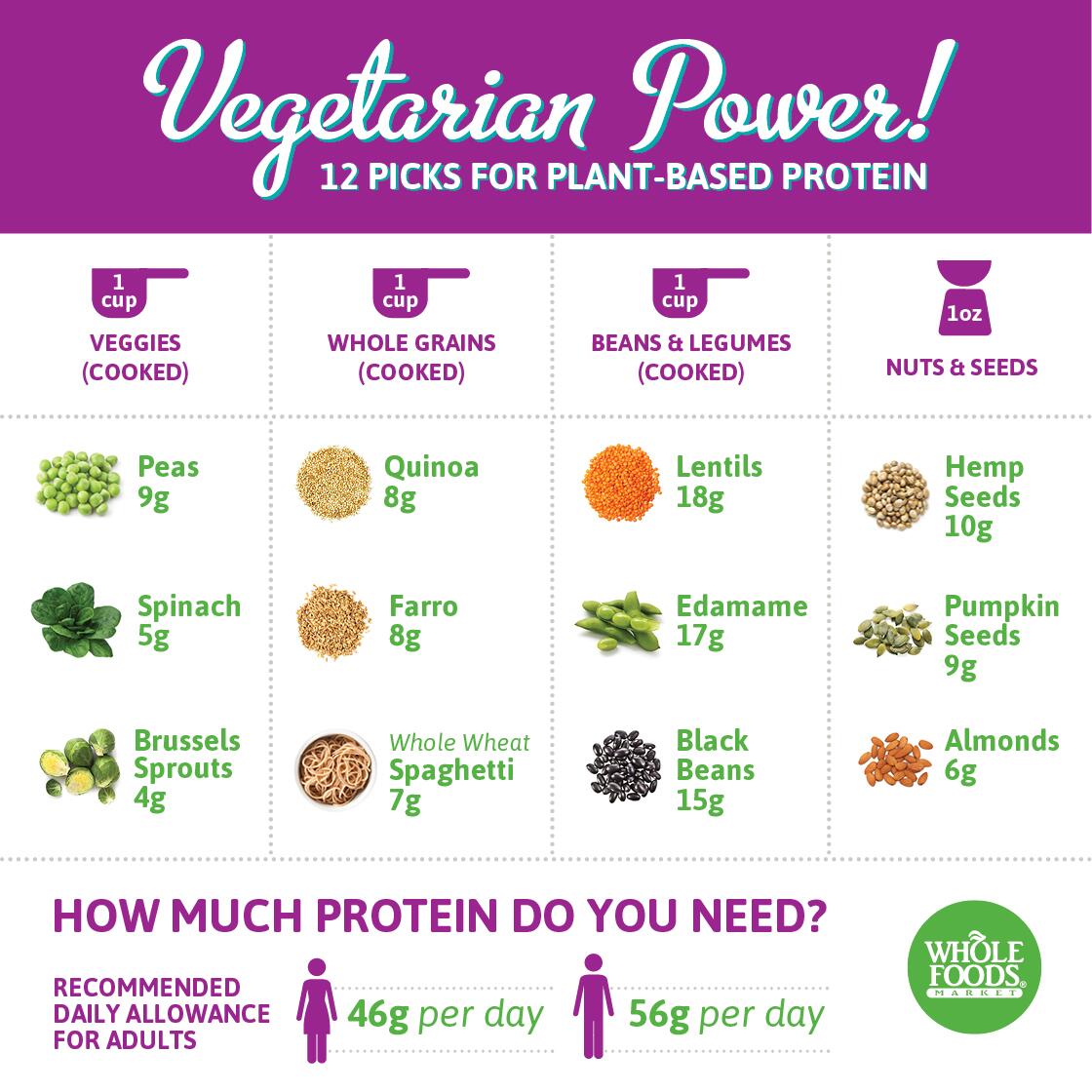

Vegetarian Power

Most of us have the misconception that one has to consume meat protein to be strong. And most of us can't imagine a day without meat.

The idea that one has to eat meat to be strong is easily disproved by looking at nature - the strongest animals and least aggressive are herbivores, animals that eat plants and are non-meat eaters. So are horses.

Below is an infographic from Whole Foods on Vegetarian Power.

The idea that one has to eat meat to be strong is easily disproved by looking at nature - the strongest animals and least aggressive are herbivores, animals that eat plants and are non-meat eaters. So are horses.

Below is an infographic from Whole Foods on Vegetarian Power.

January 19, 2014

Flu Map 2014

This has been a brutal year for flu.

Following info is from the CDC - Centers for Disease Control and Prevention

013-2014 Influenza Season Week 2 ending January 11, 2014

All data are preliminary and may change as more reports are received.

Synopsis:

During week 2 (January 5-11, 2014), influenza activity remained high in the United States.

Viral Surveillance: Of 10,841 specimens tested and reported during week 2 by U.S. World Health Organization (WHO) and National Respiratory and Enteric Virus Surveillance System (NREVSS) collaborating laboratories, 2,721 (25.1%) were positive for influenza.

Pneumonia and Influenza Mortality: The proportion of deaths attributed to pneumonia and influenza (P&I) was above the epidemic threshold.

Influenza-Associated Pediatric Deaths: Ten influenza-associated pediatric deaths were reported.

Influenza-associated Hospitalizations: A cumulative rate for the season of 13.8 laboratory-confirmed influenza-associated hospitalizations per 100,000 population was reported.

Outpatient Illness Surveillance: The proportion of outpatient visits for influenza-like illness (ILI) was 3.6%, above the national baseline of 2.0%. All 10 regions reported ILI above region-specific baseline levels. Fourteen states experienced high ILI activity; 12 states experienced moderate ILI activity; eight states and New York City experienced low ILI activity; 16 states experienced minimal ILI activity, and the District of Columbia had insufficient data.

Geographic Spread of Influenza: The geographic spread of influenza in 40 states was reported as widespread; nine states and Guam reported regional influenza activity; the District of Columbia and Puerto Rico reported local influenza activity; one state reported sporadic influenza activity, and the U.S. Virgin Islands did not report.

A description of surveillance methods is available at: http://www.cdc.gov/flu/weekly/overview.htm

January 18, 2014

E-Commerce in the US and Across the Pond in UK

Online spending trend is clearly on an upswing.

Chart below shows online shopping in the US.

Shop online projections for 2014:

"Using data from The Omnibus Company, a consumer market research agency, the “Retail Forecast for 2014” report found that 87% of consumers planning to shop online are planning to shop the same amount or more as in 2013 with 13% planning to shop less or not at all."

- Internet Retailer

Internet is where you want to be if you want to grab a piece of the action. It is a no brainer. Become an internet entrepreneur if you want to make a change in your life and make a future, if not for yourself, at least for your family.

You use the internet everyday, why not make the internet pay you? You would like that, won't you?

Join the internet revolution.....join Market America which is now going Global!

Read below more about online spending across the pond in the UK and also in the US:

UK

From Internet Retailer

Tablets help propel U.K. e-commerce in 2013

Online shoppers in the U.K. spent 91 billion pounds (US$148.78 billion) last year, up 16% from 2012. Those shoppers more often are buying via tablets and smartphones—and often picking up their web orders inside stores.

Online shoppers in the United Kingdom spent 91 billion pounds (US$148.78 billion) in 2013, up 16% from their e-commerce spending in 2012, according to the figures released today by technology consultancy Capgemini and U.K. e-retail association Interactive Media in Retail Group, or IMRG.

Read more UK online spending >>

US

From Internet Retailer

Web and other direct retail holiday sales grew 9.3% in 2013

Sales from retailers that sell via the web, catalogs and TV in November and December hit $95.7 billion, according to the National Retail Federation. Total holiday sales grew 3.8% to $601.8 billion.

Read more US online spending >>

Chart below shows online shopping in the US.

"Using data from The Omnibus Company, a consumer market research agency, the “Retail Forecast for 2014” report found that 87% of consumers planning to shop online are planning to shop the same amount or more as in 2013 with 13% planning to shop less or not at all."

- Internet Retailer

Internet is where you want to be if you want to grab a piece of the action. It is a no brainer. Become an internet entrepreneur if you want to make a change in your life and make a future, if not for yourself, at least for your family.

You use the internet everyday, why not make the internet pay you? You would like that, won't you?

Join the internet revolution.....join Market America which is now going Global!

Read below more about online spending across the pond in the UK and also in the US:

UK

From Internet Retailer

Tablets help propel U.K. e-commerce in 2013

Online shoppers in the U.K. spent 91 billion pounds (US$148.78 billion) last year, up 16% from 2012. Those shoppers more often are buying via tablets and smartphones—and often picking up their web orders inside stores.

Online shoppers in the United Kingdom spent 91 billion pounds (US$148.78 billion) in 2013, up 16% from their e-commerce spending in 2012, according to the figures released today by technology consultancy Capgemini and U.K. e-retail association Interactive Media in Retail Group, or IMRG.

Read more UK online spending >>

US

From Internet Retailer

Web and other direct retail holiday sales grew 9.3% in 2013

Sales from retailers that sell via the web, catalogs and TV in November and December hit $95.7 billion, according to the National Retail Federation. Total holiday sales grew 3.8% to $601.8 billion.

Read more US online spending >>

January 17, 2014

How Did Best Buy Collapse So Badly?

It is not as if we all do not see this coming. Who buys at Best Buy anyway?

Personally, for the past 10 years, I had gone to Best Buy to check the TVs, computers and products I like, and then go online for my purchases. And why not? Shopping on line costs less and they ship right to your front door, especially for big items like 42 inch TVs.

That was one big reason Circuit City went out of business. It used to be the 'show room' everyone went to, to check out the products before buying online. After circuit City's demise, the go to store is Best Buy. It comes as no surprise then that Best Buy's holiday sales were so dismal.

Read this article from Yahoo!:

Online shopping's rise somehow sneaks up on retailers — and consumers win

By Michael Santoli | Michael Santoli

The online-shopping revolution has been heralded and hyped since the mid-1990s, and has been advancing quickly for a decade. So how did we end up with a consumer industry that seems unprepared for it?

Consider the evidence that's piled up over the past few months, showing growth in e-commerce has indisputably begun to upend the familiar American shopping economy:

-Visits to retail stores during the holiday-shopping season collapsed, despite broad improvement in the economy and job market. As the Wall Street Journal neatly detailed Friday, measured in-store traffic in November and December was around half the level of the same period in 2010 – a time when the economic recovery was in a significantly more fragile state. But that’s not because folks didn’t spend – industry estimates place 2013 holiday-spending growth at close to 5%.

Continue reading from Yahoo! >>

Personally, for the past 10 years, I had gone to Best Buy to check the TVs, computers and products I like, and then go online for my purchases. And why not? Shopping on line costs less and they ship right to your front door, especially for big items like 42 inch TVs.

That was one big reason Circuit City went out of business. It used to be the 'show room' everyone went to, to check out the products before buying online. After circuit City's demise, the go to store is Best Buy. It comes as no surprise then that Best Buy's holiday sales were so dismal.

Read this article from Yahoo!:

Online shopping's rise somehow sneaks up on retailers — and consumers win

By Michael Santoli | Michael Santoli

The online-shopping revolution has been heralded and hyped since the mid-1990s, and has been advancing quickly for a decade. So how did we end up with a consumer industry that seems unprepared for it?

Consider the evidence that's piled up over the past few months, showing growth in e-commerce has indisputably begun to upend the familiar American shopping economy:

-Visits to retail stores during the holiday-shopping season collapsed, despite broad improvement in the economy and job market. As the Wall Street Journal neatly detailed Friday, measured in-store traffic in November and December was around half the level of the same period in 2010 – a time when the economic recovery was in a significantly more fragile state. But that’s not because folks didn’t spend – industry estimates place 2013 holiday-spending growth at close to 5%.

Continue reading from Yahoo! >>

January 16, 2014

Dump your Multivitamins and Mineral Supplements - Newspaper articles - But Should you?

You may have read headline articles lately about multivitamins and why you should stop taking them because the articles say it is a waste of money and have no noticeable effect on you. Well, if you eat a balanced diet and exercise daily, you may skip these supplements. But do you eat a balanced diet and exercise regularly?

Read from an expert on this subject matter, Dr. Michael Roizen of Cleveland Clinic:

Are You Getting the Nutrients You Need? Probably Not! That’s Why YOU May Benefit From Vitamin and Mineral Supplements

by Michael F. Roizen, M.D.

Just before the winter holidays, the Annals of Internal Medicine published an editorial that was supposed to settle the long-running debate about the need for a multivitamin. But did it? I think it did, but with a very different summary.

Here is what the editorial said: “Most supplements do not prevent chronic disease or death, their use is not justified, and they should be avoided. This message is especially true for the general population with no clear evidence of micronutrient deficiencies, who represent most supplement users in the United States and other countries.” Translation: Your vitamin supplements probably aren’t doing much of anything for you, so stop taking them.

Case closed? Not so fast. While the studies indicated that multivitamins alone showed no evidence of benefit in already well-nourished individuals, many of whom were tested for nutrient deficiencies and found not to have any, several large subpopulations benefit substantially from taking vitamin supplements.

Read more from Cleveland Clinic >>

Read from an expert on this subject matter, Dr. Michael Roizen of Cleveland Clinic:

Are You Getting the Nutrients You Need? Probably Not! That’s Why YOU May Benefit From Vitamin and Mineral Supplements

by Michael F. Roizen, M.D.

Just before the winter holidays, the Annals of Internal Medicine published an editorial that was supposed to settle the long-running debate about the need for a multivitamin. But did it? I think it did, but with a very different summary.

Here is what the editorial said: “Most supplements do not prevent chronic disease or death, their use is not justified, and they should be avoided. This message is especially true for the general population with no clear evidence of micronutrient deficiencies, who represent most supplement users in the United States and other countries.” Translation: Your vitamin supplements probably aren’t doing much of anything for you, so stop taking them.

Case closed? Not so fast. While the studies indicated that multivitamins alone showed no evidence of benefit in already well-nourished individuals, many of whom were tested for nutrient deficiencies and found not to have any, several large subpopulations benefit substantially from taking vitamin supplements.

Read more from Cleveland Clinic >>

Want to Know What A Day in the Life of an UFO is like?

From Market America Blog

January 8, 2014

A Day in the Life: Sarah Rose and Ryan Stack

Have you ever wondered what a day in the life of some of our top UnFranchise® Owners is like? Or maybe you’re new to the business and wondering if there are people who are experiencing some of the same things you are? You’re in luck! Today marks the start of a new ma® blog series called “A Day in the Life.” Every Wednesday we’ll publish a guest blog post featuring ” a day in the life” of a different UnFranchise Owner. If there’s someone who YOU would like to see featured, let us know! But for now, check out our first post featuring a day in the life of Sarah Rose and Ryan Stack.

If I had to describe our daily lives, it would come down to these points:

Custom made

Time

Variation

Choice

Continue reading at Market America Blog >>

January 11, 2014

Bill Gross' January 2014 INVESTMENT OUTLOOK : Seesaw Rider

Below is an excerpt from Bill Gross' January 2014 INVESTMENT OUTLOOK : Seesaw Rider

"I am amazed at the fascination and emphasis placed on the u-rate during employment Fridays. Bond prices will move (in some cases by points) with a minor up or down change in unemployment relative to expectations, but when it comes to the third little pig of the litter – inflation – no one seems to care. This number – the PCE annualized inflation rate – is released near the 20th of every month but you will not see CNBC or Bloomberg analysts waiting with bated breath for its release. I do. I consider it the critical monthly statistic for analyzing Fed policy in 2014. Why? Bernanke, Yellen and their merry band of Fed governors and regional presidents have told us so. No policy rate hike until both unemployment and inflation thresholds have been breached and even then “they’re not thresholds,” they’re forks in the road that may or may not lead in a different direction. (To paraphrase Yogi Berra, “if you come to a fork in the road, you don’t have to take it!”) At the moment, the Fed’s fork or target for PCE inflation is 2.0% or higher while December’s annualized rate was only 1.2%. Miles to go before Yogi or anyone else has to begin worrying about a policy rate hike. 2016 at the earliest."

You can read more of Bill Gross' Seesaw Rider >>

"I am amazed at the fascination and emphasis placed on the u-rate during employment Fridays. Bond prices will move (in some cases by points) with a minor up or down change in unemployment relative to expectations, but when it comes to the third little pig of the litter – inflation – no one seems to care. This number – the PCE annualized inflation rate – is released near the 20th of every month but you will not see CNBC or Bloomberg analysts waiting with bated breath for its release. I do. I consider it the critical monthly statistic for analyzing Fed policy in 2014. Why? Bernanke, Yellen and their merry band of Fed governors and regional presidents have told us so. No policy rate hike until both unemployment and inflation thresholds have been breached and even then “they’re not thresholds,” they’re forks in the road that may or may not lead in a different direction. (To paraphrase Yogi Berra, “if you come to a fork in the road, you don’t have to take it!”) At the moment, the Fed’s fork or target for PCE inflation is 2.0% or higher while December’s annualized rate was only 1.2%. Miles to go before Yogi or anyone else has to begin worrying about a policy rate hike. 2016 at the earliest."

You can read more of Bill Gross' Seesaw Rider >>

January 10, 2014

Big Drop in Unemployment Rate Is Not Good News

Today's unemployment report by the Bureau of Labor Statistics:

WSJ writes:

9:59 am

Jan 10, 2014 EMPLOYMENT

Big Drop in Unemployment Rate Is Not Good News

The U.S. unemployment rate dropped a whopping 0.3 percentage point to 6.7% in December but a broader measure of unemployment was unchanged at 13.1% as hundreds of thousands left the labor force.

There was a small bit of good news in the report. The number of people employed jumped by a huge 143,000, meaning that more people got jobs last month. The problem is that the number is dwarfed by the 347,000 who dropped out of the labor force.

Part of that is payback for a big jump in the labor force in November, but a big increase in the number of discouraged workers suggest that many people gave up looking for work last month. There were 917,000 people considered discouraged, meaning they aren’t actively looking for work but want a job, up from 762,000 in November.

Read more from WSJ >>

| THE EMPLOYMENT SITUATION -- DECEMBER 2013 The unemployment rate declined from 7.0 percent to 6.7 percent in December, while total nonfarm payroll employment edged up (+74,000), the U.S. Bureau of Labor Statistics reported today. Employment rose in retail trade and wholesale trade but was down in information. |

WSJ writes:

9:59 am

Jan 10, 2014 EMPLOYMENT

Big Drop in Unemployment Rate Is Not Good News

The U.S. unemployment rate dropped a whopping 0.3 percentage point to 6.7% in December but a broader measure of unemployment was unchanged at 13.1% as hundreds of thousands left the labor force.

There was a small bit of good news in the report. The number of people employed jumped by a huge 143,000, meaning that more people got jobs last month. The problem is that the number is dwarfed by the 347,000 who dropped out of the labor force.

Part of that is payback for a big jump in the labor force in November, but a big increase in the number of discouraged workers suggest that many people gave up looking for work last month. There were 917,000 people considered discouraged, meaning they aren’t actively looking for work but want a job, up from 762,000 in November.

Read more from WSJ >>

January 9, 2014

5 Foods You Should Eat This Winter

Ever wonder what you should eat during the cold months of winter? Well, wonder no more. Cleveland Clinic has provided a list of 5 foods we should eat in winter.

Here it is - 5 Foods You Should Eat This Winter from Cleveland Clinic:

Don't live on a steady diet of hot chocolate

By Kristin Kirkpatrick, MS, RD, LD | 2/12/13

Chilly winter weather affects more than just your wardrobe and heating bill. Your body also experiences changes in energy levels, metabolism and even food preferences.

Do you react to bitter cold by skipping the gym and convincing yourself you deserve a calorie splurge to warm up and offset your discomfort? You’re not alone. But the cold truth is that no weather warrants unhealthy eating habits. Just as you shouldn’t overdo ice cream during the dog days of summer, you shouldn’t live on a steady diet of hot chocolate and warm cookies during winter.

Winterizing your diet can be healthy — and tasty — if you add a few favorite cold-weather foods. Start with these.

1. Root vegetables

2. Oatmeal

3. Soup

4. Spicy tuna roll

5. Broccoli and cauliflower

Read more from Cleveland Clinic >>

Here it is - 5 Foods You Should Eat This Winter from Cleveland Clinic:

Don't live on a steady diet of hot chocolate

By Kristin Kirkpatrick, MS, RD, LD | 2/12/13

Chilly winter weather affects more than just your wardrobe and heating bill. Your body also experiences changes in energy levels, metabolism and even food preferences.

Do you react to bitter cold by skipping the gym and convincing yourself you deserve a calorie splurge to warm up and offset your discomfort? You’re not alone. But the cold truth is that no weather warrants unhealthy eating habits. Just as you shouldn’t overdo ice cream during the dog days of summer, you shouldn’t live on a steady diet of hot chocolate and warm cookies during winter.

Winterizing your diet can be healthy — and tasty — if you add a few favorite cold-weather foods. Start with these.

1. Root vegetables

2. Oatmeal

3. Soup

4. Spicy tuna roll

5. Broccoli and cauliflower

Read more from Cleveland Clinic >>

January 8, 2014

How to Realize Your Dreams

Remember any of your dreams or fantasies when you were young? Dreams of wealth, power, fame and lots of time to roam about?

We all had such dreams and fantasies. What happened to them? Did these dreams fade away as realities set in and trump dreams and fantasies?

In our struggles through life, we often resort to dreams and recall the fantasies we had when young. Have you ever wondered how many people's dreams ever turn into realities? If so, what made and how these people realized their dreams while others failed? Are these people endowed with special capabilities? Born into the right families? Are lucky, perhaps? Or they worked hard and smarter to reach their dreams?

Earl Nightingale said, "We become what we think about!"

Think for a moment what this means, "We become what we think about!"

In the Bible, Mark 9:23, you read, "If thou canst believe, all things are possible to him that believe." Norman Vincent Peale put it this way, "This is one of the greatest laws in the universe. Fervently do I wished I had discovered it as a very young man. It dawned upon me much later in life and I found it to be one of the greatest if not my greatest discovery outside of my relationship with God. The great law briefly and simply stated is that if you think in negative terms you will get negative results, if you think in positive terms you will achieve positive results." That is the simple fact he went on to say which is of the basis of an astonishing law of prosperity and success - in three words, "believe and succeed."

George Bernard Shaw said, "People are always blaming their circumstances for what they are. I don't believe in circumstances. The people who get on in this world are the people who get up and look for the circumstances they want and if they can find them make them. Well, it's pretty apparent isn't it? And every person who discovered this for a while believed that he was the first one to work it out - we become what we think about."

The above two paragraphs are quotes from Earl Nightingale's talk - "The Strangest Secret."

Dream of becoming rich so you can help others? Noble thought. Yes, go think and dream about it night and day. Believe in this thought. Put efforts and work towards it, and inevitably, you will become what you think about.

Congratulations! Now you can count yourself among people who had realized their dreams!

We all had such dreams and fantasies. What happened to them? Did these dreams fade away as realities set in and trump dreams and fantasies?

In our struggles through life, we often resort to dreams and recall the fantasies we had when young. Have you ever wondered how many people's dreams ever turn into realities? If so, what made and how these people realized their dreams while others failed? Are these people endowed with special capabilities? Born into the right families? Are lucky, perhaps? Or they worked hard and smarter to reach their dreams?

Earl Nightingale said, "We become what we think about!"

Think for a moment what this means, "We become what we think about!"

In the Bible, Mark 9:23, you read, "If thou canst believe, all things are possible to him that believe." Norman Vincent Peale put it this way, "This is one of the greatest laws in the universe. Fervently do I wished I had discovered it as a very young man. It dawned upon me much later in life and I found it to be one of the greatest if not my greatest discovery outside of my relationship with God. The great law briefly and simply stated is that if you think in negative terms you will get negative results, if you think in positive terms you will achieve positive results." That is the simple fact he went on to say which is of the basis of an astonishing law of prosperity and success - in three words, "believe and succeed."

George Bernard Shaw said, "People are always blaming their circumstances for what they are. I don't believe in circumstances. The people who get on in this world are the people who get up and look for the circumstances they want and if they can find them make them. Well, it's pretty apparent isn't it? And every person who discovered this for a while believed that he was the first one to work it out - we become what we think about."

The above two paragraphs are quotes from Earl Nightingale's talk - "The Strangest Secret."

Dream of becoming rich so you can help others? Noble thought. Yes, go think and dream about it night and day. Believe in this thought. Put efforts and work towards it, and inevitably, you will become what you think about.

Congratulations! Now you can count yourself among people who had realized their dreams!

January 7, 2014

How Sleep Deprivation Decays the Mind and Body

If you have always wondered about what sleep deprivation does to your body......wonder no more. The article below from The Atlantic shows how lack of sleep decays both the mind and the body. Now that you know why sleep is so necessary, you will think twice about having all nighters and catch up with your sleep during he weekend.

Here is the article from The Atlantic:

How Sleep Deprivation Decays the Mind and Body

Getting too little sleep can have serious health consequences, including depression, weight gain, and heart disease. It is torture. I know.

SETH MAXON | DEC 30 2013

I awoke in a bed for the first time in days. My joints ached and my eyelids, which had been open for so long, now lay heavy as old hinges above my cheekbones. I wore two pieces of clothing: an assless gown and a plastic bracelet.

I remembered the hallway I had been wheeled down, and the doctor’s office where I told the psychiatrist he was the devil, but not this room. I forced myself up and stumbled, grabbing the chair and the bathroom doorknob for balance. I made it to the toilet, then threw water on my face at the sink, staring into the mirror in the little lavatory. My tousled hair shot out around my puffy face; my head throbbed. I looked hungover.

In those first moments, I remembered the basics about what had landed me in the hospital: Some pseudo-philosophical ranting and flailing brought on by a poorly executed experiment to see how long I could last without sleep.

I was 18, in Italy, on a school-sponsored trip with that pompously misnamed group for American teens who earn As and Bs, the National Honor Society. I stayed up writing all night, and the next morning, on little more than impulse, I decided to go for it.

Why? There are a few layers of “why,” and I will mine them later.

Read more from The Atlantic >>

Here is the article from The Atlantic:

How Sleep Deprivation Decays the Mind and Body

Getting too little sleep can have serious health consequences, including depression, weight gain, and heart disease. It is torture. I know.

SETH MAXON | DEC 30 2013

I awoke in a bed for the first time in days. My joints ached and my eyelids, which had been open for so long, now lay heavy as old hinges above my cheekbones. I wore two pieces of clothing: an assless gown and a plastic bracelet.

I remembered the hallway I had been wheeled down, and the doctor’s office where I told the psychiatrist he was the devil, but not this room. I forced myself up and stumbled, grabbing the chair and the bathroom doorknob for balance. I made it to the toilet, then threw water on my face at the sink, staring into the mirror in the little lavatory. My tousled hair shot out around my puffy face; my head throbbed. I looked hungover.

In those first moments, I remembered the basics about what had landed me in the hospital: Some pseudo-philosophical ranting and flailing brought on by a poorly executed experiment to see how long I could last without sleep.

I was 18, in Italy, on a school-sponsored trip with that pompously misnamed group for American teens who earn As and Bs, the National Honor Society. I stayed up writing all night, and the next morning, on little more than impulse, I decided to go for it.

Why? There are a few layers of “why,” and I will mine them later.

Read more from The Atlantic >>

January 6, 2014

Study: Having Medicaid increases emergency room visits

From MIT News

Study: Having Medicaid increases emergency room visits

Unique study on Oregon’s citizens sheds light on critical care in the U.S.

Peter Dizikes, MIT News Office

Adults who are covered by Medicaid use emergency rooms 40 percent more than those in similar circumstances who do not have health insurance, according to a unique new study, co-authored by an MIT economist, that sheds empirical light on the inner workings of health care in the U.S.

The study takes advantage of Oregon’s recent use of a lottery to assign access to Medicaid, the government-backed health-care plan for low-income Americans, to certain uninsured adults. The research examines emergency room records for roughly 25,000 people over 18 months.

“When you cover the uninsured, emergency room use goes up by a large magnitude,” says Amy Finkelstein, the Ford Professor of Economics at MIT and a principal investigator of the study, along with Katherine Baicker, a professor at the Harvard School of Public Health.

Read more from MIT News >>

Study: Having Medicaid increases emergency room visits

Unique study on Oregon’s citizens sheds light on critical care in the U.S.

Peter Dizikes, MIT News Office

Adults who are covered by Medicaid use emergency rooms 40 percent more than those in similar circumstances who do not have health insurance, according to a unique new study, co-authored by an MIT economist, that sheds empirical light on the inner workings of health care in the U.S.

The study takes advantage of Oregon’s recent use of a lottery to assign access to Medicaid, the government-backed health-care plan for low-income Americans, to certain uninsured adults. The research examines emergency room records for roughly 25,000 people over 18 months.

“When you cover the uninsured, emergency room use goes up by a large magnitude,” says Amy Finkelstein, the Ford Professor of Economics at MIT and a principal investigator of the study, along with Katherine Baicker, a professor at the Harvard School of Public Health.

Read more from MIT News >>

Power Profile: Shannon Goodberry

...So to me everyone needs to take a look at it.

If not for them, they know somebody that can have their life changed

by just being passionate about caring about others.

January 5, 2014

Why you Should Worry, If You Hold Munis in 2014

If you have substantial holdings in municipal bonds, you should worry because of tiny island Puerto Rico. As Forbes reports, "a staggering 75% of Us muni bond funds are lending money to Puerto Rico."

The ramifications can be staggering when you consider what Forbes report:er, Larry McDonald wrote:

"Texas’s state government debt is relatively modest, near $40 billion, or $1,577 per resident. Puerto Rico’s public debt of $53 billion is nearly $15,000 per person, but when we add inter-governmental debt the mountain rises to $70 billion, or $17,500 per person. Throw in a violently under-funded pension and healthcare obligations, the noose approaches $160 billion. That’s $46,000 per person, enough to make one think about trying a swim for Miami."

Below is an excerpt from Forbes:

Could a Puerto Rico Default Hammer the $3.7 Trillion US Muni-Bond Market in 2014?

"A democracy will continue to exist up until the time that voters discover they can vote themselves generous gifts from the public treasury. From that moment on, the majority always votes for the candidates who promise the most benefits from the public treasury, with the result that every democracy will finally collapse due to loose fiscal policy, which is always followed by a dictatorship."

- Alexis de Tocqueville 1835

As we head into 2014, you may be asking why we are concerned about a small island located in the Caribbean Sea, about a thousand miles southeast of Miami. Geographically, it is a mere speck on the map… practically irrelevant. In fact, 70 islands the size of Puerto Rico could fit comfortably into the state of Texas. However, the debt burden currently burying this economy may eventually send nasty tremors into the United States’ municipal bond market.

Surprisingly, of all the US muni bond funds, a staggering 75% of them are lending money to Puerto Rico, leaving millions of US investors and a large portion of US brokerage accounts exposed to this beleaguered little island. We suspect Puerto Rico will become America’s Greece. If swans could fly this far south, they would without question be the color of night.

Read more from Forbes >>

The ramifications can be staggering when you consider what Forbes report:er, Larry McDonald wrote:

"Texas’s state government debt is relatively modest, near $40 billion, or $1,577 per resident. Puerto Rico’s public debt of $53 billion is nearly $15,000 per person, but when we add inter-governmental debt the mountain rises to $70 billion, or $17,500 per person. Throw in a violently under-funded pension and healthcare obligations, the noose approaches $160 billion. That’s $46,000 per person, enough to make one think about trying a swim for Miami."

Below is an excerpt from Forbes:

Could a Puerto Rico Default Hammer the $3.7 Trillion US Muni-Bond Market in 2014?

"A democracy will continue to exist up until the time that voters discover they can vote themselves generous gifts from the public treasury. From that moment on, the majority always votes for the candidates who promise the most benefits from the public treasury, with the result that every democracy will finally collapse due to loose fiscal policy, which is always followed by a dictatorship."

- Alexis de Tocqueville 1835

As we head into 2014, you may be asking why we are concerned about a small island located in the Caribbean Sea, about a thousand miles southeast of Miami. Geographically, it is a mere speck on the map… practically irrelevant. In fact, 70 islands the size of Puerto Rico could fit comfortably into the state of Texas. However, the debt burden currently burying this economy may eventually send nasty tremors into the United States’ municipal bond market.

Surprisingly, of all the US muni bond funds, a staggering 75% of them are lending money to Puerto Rico, leaving millions of US investors and a large portion of US brokerage accounts exposed to this beleaguered little island. We suspect Puerto Rico will become America’s Greece. If swans could fly this far south, they would without question be the color of night.

Read more from Forbes >>

January 4, 2014

Power Profile: Sharon Lawrence

....So what attracted me most to Market America was that I can build the business part time while working my traditional business full-time, and potentially create an ongoing income. And luckily for me it worked. After six years of affiliating with the company, I was able to shut my company down and fire myself and free up my time and my life.

- Sharon Lawrence

Will Your 2014 be the Same as 2013?

Well, the holidays are over, just as they always do - all the shopping, eating, partying and having a jolly good time with family and friends.

Now it is back to work and all the bills to pay after a month long of credit card swiping which made spending easy. Thank goodness for that piece of plastic!

So the question remains, will your 2014 be the same as 2013?

If you have no other dreams or hopes, and you continue to do the same old thing, of course, my dear friend, no surprise there - your 2014 will be the same as 2013 as they were in 2012. Why would your new year be any different if you continue to do the same thing? Someone famously call this insanity - doing the same thing and expect a different result!

It is your life. If you choose to live this way....it is your choice. But do you really want to live like this, just like a hamster spinning the wheel and not going anywhere?

If you are looking for change and be free from this hamster wheel, take a look at Market America. Who knows, you may find your entrepreneurial self and free yourself from this slave machine, and in the process achieve your time and financial freedom!

Now, that would be an excellent reason to toast for a new life!

Now it is back to work and all the bills to pay after a month long of credit card swiping which made spending easy. Thank goodness for that piece of plastic!

So the question remains, will your 2014 be the same as 2013?

If you have no other dreams or hopes, and you continue to do the same old thing, of course, my dear friend, no surprise there - your 2014 will be the same as 2013 as they were in 2012. Why would your new year be any different if you continue to do the same thing? Someone famously call this insanity - doing the same thing and expect a different result!

It is your life. If you choose to live this way....it is your choice. But do you really want to live like this, just like a hamster spinning the wheel and not going anywhere?

If you are looking for change and be free from this hamster wheel, take a look at Market America. Who knows, you may find your entrepreneurial self and free yourself from this slave machine, and in the process achieve your time and financial freedom!

Now, that would be an excellent reason to toast for a new life!

January 3, 2014

From MarketWatch

Morningstar

You should be worried about growing inequality. Yes, in the broad economy, but also if you’re in the fund industry competing against Vanguard.

Jack Bogle’s company continued to dominate the industry last year, says a Morningstar report out Friday looking at 2013 flows.

The Vanguard Group took in $117 billion of long-term mutual fund and ETF assets as of Nov. 30. That’s out of $425 billion raked in by the whole industry.

You could think of it as more than $1 of every $4 invested in funds during 2013, as Barron’s Brendan Conway puts it.

Morningstar analyst Michael Rawson writes:

“Vanguard has finished first or second in terms of flows in all but two of the past 20 years. This has allowed the firm to increase its market share to 18% from just 8% two decades ago and places it well ahead of rivals Fidelity and American Funds, both of which have lost market share over the past five years.”

Read more from MarketWatch >>

Morningstar

You should be worried about growing inequality. Yes, in the broad economy, but also if you’re in the fund industry competing against Vanguard.

Jack Bogle’s company continued to dominate the industry last year, says a Morningstar report out Friday looking at 2013 flows.

The Vanguard Group took in $117 billion of long-term mutual fund and ETF assets as of Nov. 30. That’s out of $425 billion raked in by the whole industry.

You could think of it as more than $1 of every $4 invested in funds during 2013, as Barron’s Brendan Conway puts it.

Morningstar analyst Michael Rawson writes:

“Vanguard has finished first or second in terms of flows in all but two of the past 20 years. This has allowed the firm to increase its market share to 18% from just 8% two decades ago and places it well ahead of rivals Fidelity and American Funds, both of which have lost market share over the past five years.”

Read more from MarketWatch >>

Vitamin E Slows Decline in Alzheimer's

From MedPage Today

Vitamin E Slows Decline in Alzheimer's

Published: Jan 2, 2014

By John Gever, Deputy Managing Editor, MedPage Today

Reviewed by F. Perry Wilson, MD, MSCE; Instructor of Medicine, Perelman School of Medicine at the University of Pennsylvania

Older veterans with mild to moderate Alzheimer's disease who took vitamin E supplements in a randomized trial showed less progression of functional impairment, researchers said.

With mean follow-up of 2.27 years (SD 1.22), the 140 patients assigned to daily supplements of 2,000 IU of vitamin E (alpha tocopherol) had mean declines in Alzheimer's Disease Cooperative Study Activities of Daily Living (ADCS-ADL) scores of 13.81 points (SD 1.11), compared with a drop of 16.96 points (SD 1.11) in a placebo group, reported Maurice Dysken, MD, of the Minneapolis VA Health System, and colleagues.

The difference of 3.15 points was statistically significant (95% CI 0.92-5.39), the researchers reported in the Jan. 1 issue of the Journal of the American Medical Association. It remained significant after adjusting for baseline factors, with a P value of 0.03.

Read more from MedPage Today >>

Vitamin E Slows Decline in Alzheimer's

Published: Jan 2, 2014

By John Gever, Deputy Managing Editor, MedPage Today

Reviewed by F. Perry Wilson, MD, MSCE; Instructor of Medicine, Perelman School of Medicine at the University of Pennsylvania

Older veterans with mild to moderate Alzheimer's disease who took vitamin E supplements in a randomized trial showed less progression of functional impairment, researchers said.

With mean follow-up of 2.27 years (SD 1.22), the 140 patients assigned to daily supplements of 2,000 IU of vitamin E (alpha tocopherol) had mean declines in Alzheimer's Disease Cooperative Study Activities of Daily Living (ADCS-ADL) scores of 13.81 points (SD 1.11), compared with a drop of 16.96 points (SD 1.11) in a placebo group, reported Maurice Dysken, MD, of the Minneapolis VA Health System, and colleagues.

The difference of 3.15 points was statistically significant (95% CI 0.92-5.39), the researchers reported in the Jan. 1 issue of the Journal of the American Medical Association. It remained significant after adjusting for baseline factors, with a P value of 0.03.

Read more from MedPage Today >>

January 1, 2014

The Downside of Early Retirement

From Yahoo News

The Downside of Early Retirement

By Tom Sightings

A lot of my fellow baby boomers, in their 50s and early 60s, find they have an option to take early retirement. Some are teachers or other public employees who can opt for retirement after a certain number of years of service, which often puts them in their 50s. Others have been offered an early retirement package from their company. The package seems like a lot of money, so they're tempted to take it.

First of all, if you have a choice of when to retire, consider yourself lucky. Many employees, including yours truly, get booted out of the workplace when they're in their 50s. Suddenly there's no more paycheck, no more benefits and no more contributions to your 401(k) plan. People who take early retirement are typically left to their own devices.

For some people, this can be a good thing. One colleague of mine, age 52, used his layoff as an opportunity to change careers. He found a fast-track program to train as a science teacher and now happily teaches in a middle school. Another friend took a package, then got a job as an office administrator at a local counseling group. He makes somewhat less money, but there's less stress and no more commute.

But far too many 50-somethings leave their familiar place of work only to find that they are unemployable at any comparable position. I have one friend working for minimum wage at the checkout counter at the supermarket. Another friend takes tee times at our public golf course for - you guessed it - minimum wage. Still another friend, who thought he could afford to retire, is now trying to sell real estate, which is no easy job in this economy.

Read more from Yahoo News >>

The Downside of Early Retirement

By Tom Sightings

A lot of my fellow baby boomers, in their 50s and early 60s, find they have an option to take early retirement. Some are teachers or other public employees who can opt for retirement after a certain number of years of service, which often puts them in their 50s. Others have been offered an early retirement package from their company. The package seems like a lot of money, so they're tempted to take it.

First of all, if you have a choice of when to retire, consider yourself lucky. Many employees, including yours truly, get booted out of the workplace when they're in their 50s. Suddenly there's no more paycheck, no more benefits and no more contributions to your 401(k) plan. People who take early retirement are typically left to their own devices.

For some people, this can be a good thing. One colleague of mine, age 52, used his layoff as an opportunity to change careers. He found a fast-track program to train as a science teacher and now happily teaches in a middle school. Another friend took a package, then got a job as an office administrator at a local counseling group. He makes somewhat less money, but there's less stress and no more commute.

But far too many 50-somethings leave their familiar place of work only to find that they are unemployable at any comparable position. I have one friend working for minimum wage at the checkout counter at the supermarket. Another friend takes tee times at our public golf course for - you guessed it - minimum wage. Still another friend, who thought he could afford to retire, is now trying to sell real estate, which is no easy job in this economy.

Read more from Yahoo News >>

Subscribe to:

Comments (Atom)